Improving Online Claims Filing

Alignment & Planning

The Ask -

Our business wanted to increase the number of people who file a claim online to reduce the amount of time it takes to handle a claim and to reduce the costs associated with call centers. If more people filed a claim through the website it was hypothesized that it would lead to better overall experiences and lower operational costs.

Planning -

Data Deep Dive - First, we wanted to establish what we knew already about the experience. We partnered with data to get a rundown of claims completed by method, type, and who was reporting the claim. Then we went through the current experience to get more familiar with the process today.

Execution

Customer Feedback

We partnered with the Customer Experience team to review closed-Loop feedback gathered from our Operations team to uncover common complaints from customers who experienced a claim.

Interviews

We partnered with the product team to plan for a round of interviews with customers who had recently filed a claim as well as with customers of other companies to learn about their experience.

10 Customers who experienced a claim recently; 10 Customers of other insurance companies to understand; 3 Claims employees who take claim reports over the phone

Goal -

To understand the experience at the scene of the incident, when filing the claim, and following-up

What did they do and why?

To understand why they didn’t choose other options available to them.

Surveys

Surveyed 200 people to understand:

how they filed their claim and why they did it that way

Biggest pain points

Their feelings towards online claim filing

Execution

Customer Feedback

We partnered with the Customer Experience team to review closed-Loop feedback gathered from our Operations team to uncover common complaints from customers who experienced a claim.

Interviews

We partnered with the product team to plan for a round of interviews with customers who had recently filed a claim as well as with customers of other companies to learn about their experience.

10 Customers who experienced a claim recently; 10 Customers of other insurance companies to understand; 3 Claims employees who take claim reports over the phone

Goal -

To understand the experience at the scene of the incident, when filing the claim, and following-up

What did they do and why?

To understand why they didn’t choose other options available to them.

Surveys

Surveyed 200 people to understand:

how they filed their claim and why they did it that way

Biggest pain points

Their feelings towards online claim filing

Results

The interviews and survey uncovered a few notable issues with online claim filing –

Lack of Awareness

Received a follow-up call prior to completing the online flow

Claimants weren’t able to complete a claim online without an account

Flow was too long and they couldn’t complete it in one setting (67 questions!)

They were nervous they’ll mess something up

Outcomes

Each theme had a different approach attached to it:

Lack of Awareness –

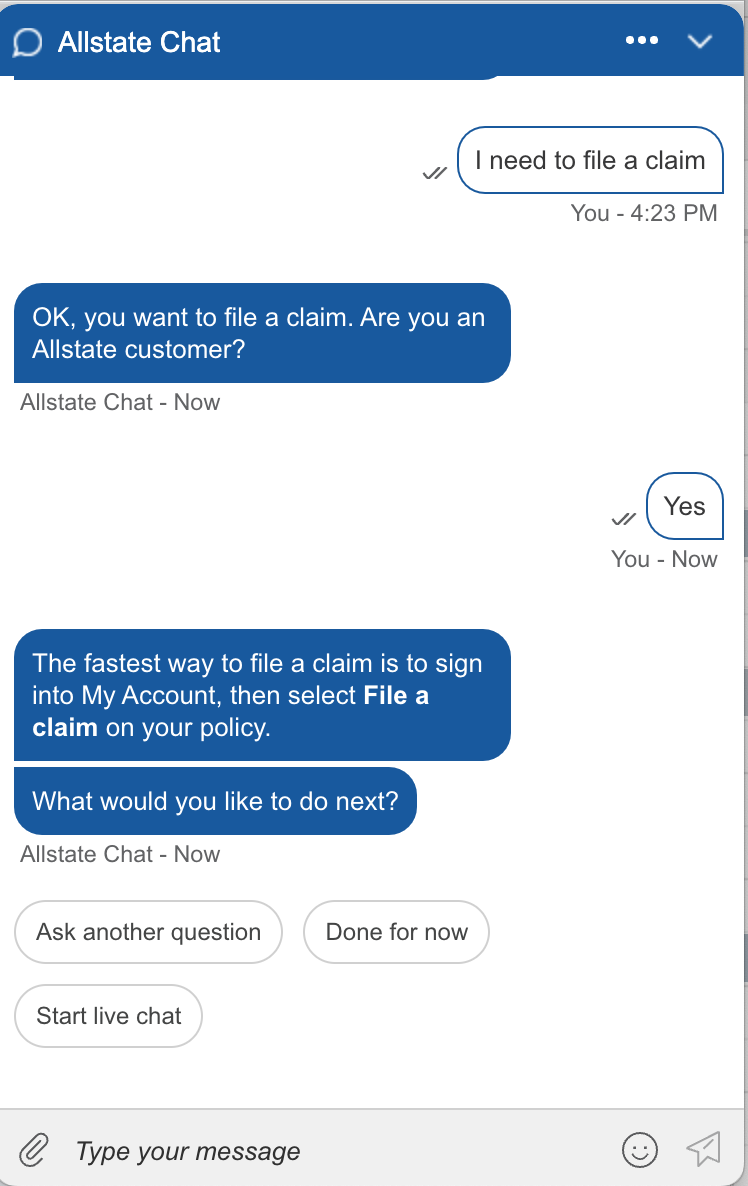

The research showed that most customers called because of the number on the ID card, the website displayed the number, and the chat support on the site also pushed them to call

Solution – The quickest way to increase adoption was to change the website and chat info to push the digital option along with the phone number if they wanted to call

Outcome – Immediate increase in the number of claims filed digitally

Receiving a Phone Call During The Task –

What we discovered during our follow-up conversation with Operations is that the claim is started in the system after the customer finishes. This created a to-do for someone in the claims department to follow-up with the customer. They were sometimes so quick that they called the customer before they finished the rest of the flow.

Solution - We asked the operations team to hold the to-do for a bit prior to them calling the customer

Outcome – Immediate reduction in drop-offs in the flow

Claimants Unable to File Online

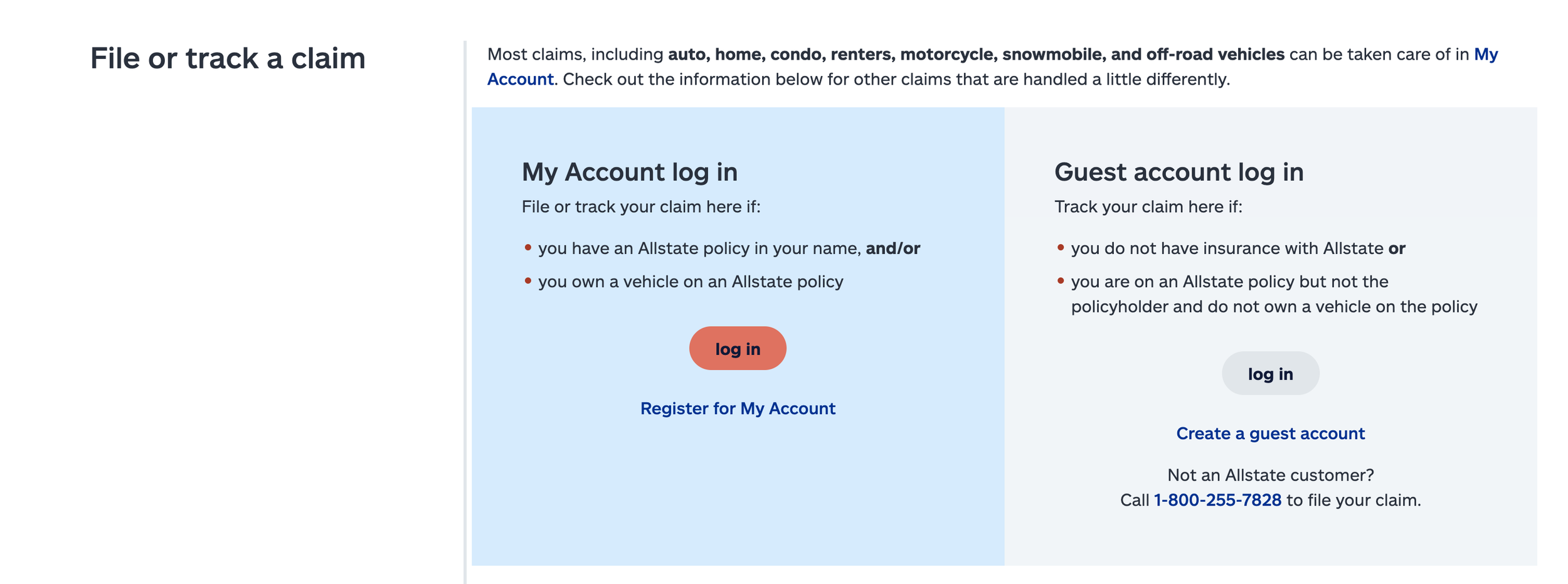

The research showed that customers who needed to file with another insurance company did sometimes want to file online. But our current solution didn’t allow for them to file online without setting up an account

We also discovered that 1/3 of our calls to the call center came from other insurance carriers filing a claim on behalf of their customer

Solution – Create a guest account for non-customers and create a separate platform for insurance employees filing for their customers

Outcome – Immediate reduction in calls into our call center and faster claim resolution times

Lengthy Experience -

The research showed that people dropped out of the flow because it was too long. We met with multiple teams within claims to understand what questions had to be asked to open a claim and what was considered a “nice to have”. We learned that once a claim was opened there was always a follow-up call with the customer and many of the questions they ask there are redundant so we could save those questions for that conversation.

Solution - We were able to significantly reduce the number of questions in the filing flow to around 25 questions. This was launched in phases and measured to make sure we didn’t make any changes with unintended consequences.

Outcome – Immediate reduction in drop-offs in the flow